News

Commercial agents appointed at Worcestershire retail and leisure destination

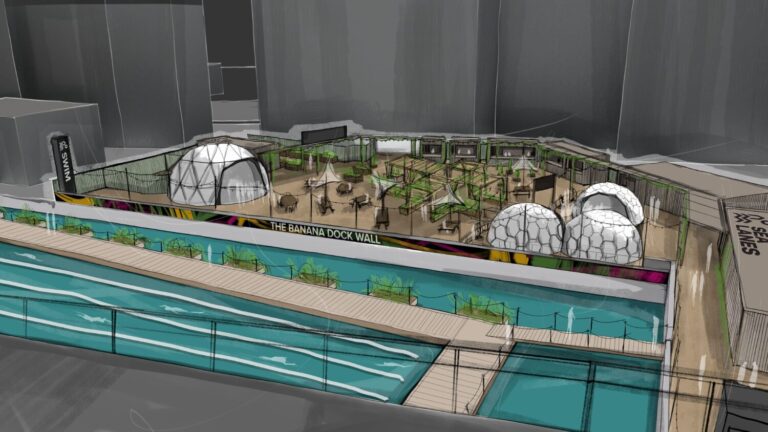

5th January 2026The Valley in Evesham, Worcestershire has appointed the Bristol office of Carter Jonas as commercial agents, working alongside the landlord Eagle One. Situated within a 115-acre park, the 30-unit retail and leisure scheme is anchored by the 40,000 sq ft Blue Diamond Garden Centre. Tenants at The Valley include Fat Face, ProCook, Quba, Weird Fish, Crew, Barbour, Cotton Traders, Coffee#1, Regatta, and Saltrock. The scheme has also evolved over the last few years to accommodate a blend of retail and leisure, now offering attractions such as Adventure Golf, Aerial Adventure, a miniature Steam Railway, Splash Pad, and walking trails. It is also supplemented by 570 free parking spaces. Phil Maclean, retail director at Eagle One, said: “We are pleased to welcome the Carter Jonas team to assist with our marketing efforts and add to the exciting plans we have for the centre. The Valley is entering an exciting new phase of development and evolution. We’re delighted to welcome Carter Jonas to help us deliver our ambitious plans and create even more reasons for visitors to return.”

Deals

Popeyes makes regional drive-through debut at Coventry’s Arena Shopping Park, anchoring 30,000 sq ft of new lettings

12th December 2025Popeyes has opened its first drive-through in the West Midlands at Coventry’s Arena Shopping Park, as the scheme welcomes over 30,000 sq ft of new lettings. The fried chicken chain’s new location extends to 2,281 sq ft, offering its full menu of chicken, tenders, wraps, with up to 66 internal and 24 external covers. The brand joins the existing F&B offer at Arena Shopping Park which includes the likes of Costa, Burger King, Nando’s, and M&S Café. Also adding to the F&B lineup at the scheme is Five Guys, which has also opened a drive-through restaurant. The operator has taken 3,100 sq ft, offering its burgers and fries to up to 65 inside diners with a further 36 external covers. Meanwhile, Smyths Toys has opened a 15,104 sq ft store within the scheme, adjacent to Next. Also joining the scheme is The Works, which has opened a 1,228 sq ft location within The Mall, offering a range of arts and crafts, stationery, toys, and books. Finally, PureGym has opened a 24-hour facility within a 8,730 sq ft space, becoming the first gym operator to join Arena Shopping Park. Louisa Butters, head of retail asset management UK at CBRE Investment Management, […]

Requirements

M&S expands search for new sites as it looks to double size of food business

25th November 2025Marks & Spencer has expanded its search for new properties as the retailer aims to double the size of its food business. The retailer has launched a list of 500 new target locations across the UK it is considering for new and renewed food stores. M&S is looking for highly visible and accessible sites across the UK that are capable of delivering trading space of 18,000 sq ft. Within the M25, the retailer is targeting prominent sites in all areas that benefit from strong public transport links, steady footfall throughout the week, and are capable of delivering M&S food halls with trading space of between 6,000 sq ft and 18,000 sq ft. This comes as M&S prepares to open 20 new or renewed stores between November and March. All of these stores will be in M&S’s new renewal format, which offers an extended range of M&S Food, wider aisles, and larger car parks. Target locations include areas where there is not yet an M&S store such as Hove, Marlborough and Wallingford. Alex Freudmann managing director of M&S Food said: “The strong performance of our new M&S food stores gives us the confidence to explore even more locations across the UK, from […]

Insights

Industry comment: Looking ahead to 2026 – part two

18th December 2025This article is a continuation of our Looking ahead to 2026 piece. You can find part one here. Neil Hockin, joint managing director at LM: “This year has highlighted the speed at which consumer-facing sectors evolve, and our industry must keep closing the gap between fast-moving customer behaviour and the traditionally slower pace of property. Covid showed how quickly habits can shift and that pace has not eased. We have strengthened our team with fresh talent to deepen our insight and deliver best-in-class advice across our four divisions: retail leasing, lease advisory, investment and restaurants and leisure. “High streets and shopping centres continue to diversify, with more leisure, community and experiential concepts. Recent additions such as Guinness World Records at The O2 and the immersive gaming brand Activate show how demand for social, engaging activities is growing. Quick-service restaurant operators remain active, particularly in the chicken sector where competitive tension from new and exiting brands is driving rental growth, while high street staples like Next, Primark and TK Maxx continue to trade strongly. We are also seeing regional growth from iconic brands with a strong West End presence, including ALO Yoga and Wax London’s signing in Victoria Quarter Leeds. Although our principal […]

More Latest Retail News