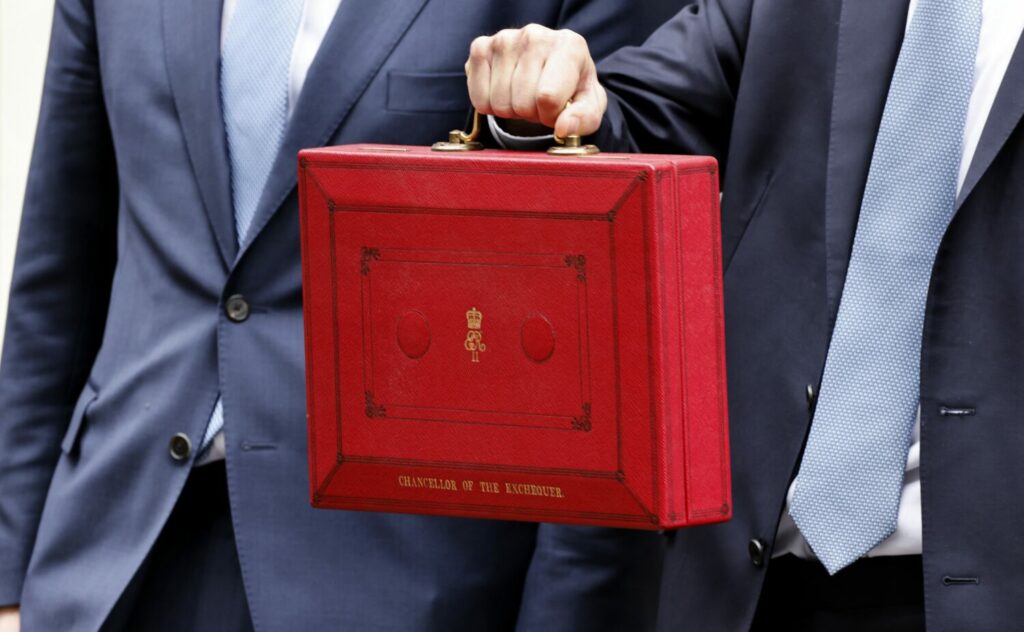

Spring Budget: Chancellor has failed to “right the wrongs” of the Autumn Statement

The Chancellor Jeremy Hunt’s Spring Budget has failed to “right the wrongs” of the 2023 Autumn Statement by not cancelling planned business rates increases in April, Colliers’ head of business rates has said.

John Webber said that given the Office for Budget Responsibility’s forecast that inflation will be below 2% in two months time, it is “outrageous” that all but the smallest of UK businesses will be paying increased business rates tied to a multiplier in line with the 6.7% inflation figures of last September.

Colliers says this planned increase will impact 220,000 businesses, who are set to pay an extra burden of £1.66bn in tax from April 1. This includes businesses in the retail sector, who Colliers says will pay over £360 million more in business rates.

Webber also criticised the Chancellor’s decision to extend the period for which an occupier must occupy a property to gain empty rates relief, from six weeks to thirteen weeks, describing it as a “kick in the teeth” for landlords who are unable to find a tenant for their property. He added that this is likely to deter property investment in an already distressed market.

Webber also said that Colliers is “disappointed” that the Chancellor did not extend the retail, hospitality and leisure relief for small companies that he announced in November, adding that the temporary nature of the relief requires an annual review which leaves businesses unable to plan for more than a year in the future.

He said: “All in all a very disappointing budget in terms of business rates. The Chancellor spoke of creating a tax regime pro-business, designed for further “levelling up” and competing on the European stage. Yet nowhere else in Europe do businesses pay approaching 60% the rental of their premises in property taxes and at current levels this is unsustainable and deters new investment in businesses.

“This is a damning indictment for the Conservative Government who have failed their manifesto promise to reduce this tax.”

Colliers is not the only voice to criticise the Chancellor’s Spring Budget, with Vivienne King, chair of the Shopkeeper’s Campaign, saying the Government has “squandered” its last chance to keep its manifesto promise to reduce business rates for retail.

King said: “The current business rates regime is a drain on retailers. It drives would-be investors in the UK’s commercial real estate market into the arms of our European competitors. The burden has become so great that entrepreneur after entrepreneur and chain after chain of shops are going into administration. We are going to see more shuttered up shops up and down our high streets and in our town centres.”

“This was the Conservative Party’s last chance to keep their Manifesto promise to reduce business rates before the next election. Retailers across the country will feel betrayed as they continue to suffer under one of the most punitive property tax regimes in Europe.”

Today the Chancellor announced that the VAT threshold for small businesses will be increased, from £85,000 to £90,000, following campaigns from the Federation of Small Businesses.

Earlier this week, the chief executive of M&S called on the Government to fix the “broken” business rates system.