Commercial real estate market boomed in 2023 despite economic challenges

Commercial real estate activity saw a boom in 2023 despite economic challenges, according to a new report.

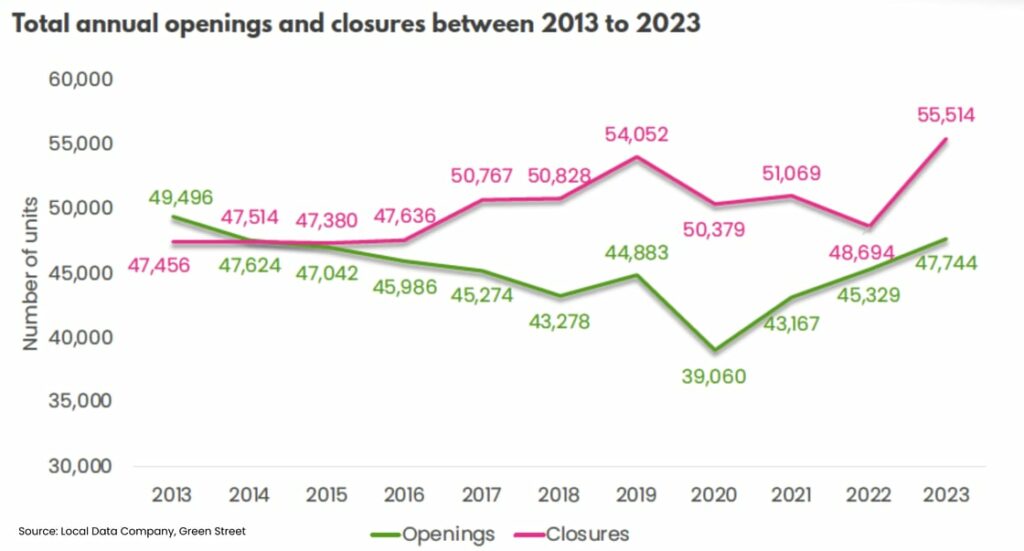

Research from Local Data Company (LDC) and Green Street found a spike in the number of both closures and openings in the retail and leisure sectors, representing significant churn.

The year saw increases in interest rates and operational costs, compounding challenges already faced by British businesses and leading to a year-on-year increase in closures of 14%, the report found. However, these closures were somewhat mitigated by an increase in openings of 5% during the same period.

The report said that innovative changes of use and retail-to-residential conversions have become increasingly attractive and offer an economically viable option to address vacancies, align locations with current demand, and revitalise town centres.

Historical openings and closures across GB, 2013 – 2023 (Local Data Company, Green Street)

Retail parks were found to have performed particularly well, continuing the positive trajectory they have recorded over recent years. They were also the only location type to have seen a positive change in 2023, recording a net increase in units of 0.4%. Demand also remained high for retail park units, driving a 1.4% year-on-year decrease in vacancy rate. A further decrease is anticipated as retailers continually look to out-of-town units to expand their offer.

While this increase in out-of-town meant that there was a 1.3% decrease in shopping centre units, vacancy did improve by 0.5%, reflecting ongoing post-pandemic efforts to attract occupiers and convert space. Analysis by Green Street found that a strong, experience-led tenant mix is the key to thriving shopping centres. For many in the sector the focus has been on creating immersive in-store experiences and prioritising highly-visible prime locations.

The fastest-growing categories in 2023 included barbers, nail salons, and beauty salons, reflecting sustained demand for personal grooming services. Convenience stores also saw expansion, with smaller-format stores ideally positioned to cater to cost of living-influenced shopping trends for more frequent trips and smaller basket sizes. Green Street said that community provision will continue to be a major theme in local retail strategies, with mixed-use development projects becoming easier to realise following changes to UK planning regulations.

Lucy Stainton, commercial director at Local Data Company, said: “2023 was a period of significant volatility and churn, with activity across the market in terms of openings and closures far beyond anything we’ve seen in the previous couple of years. Whilst the spike in closures can’t be ignored, the fact this sits alongside increased levels of new store openings, seems to indicate operators are continuing to restructure and repurpose their portfolios rather than a terminal market decline.

“The sectors most affected by closures all point to the continuing impact of higher energy prices in ‘23, such as pubs and hairdressers and a change in demand for more digital led services such as with the banks and estate agents. As we look forward across 2024, we expect to see such high levels of churn temper, as many large operators come towards the end of any material rationalisation programmes, as well as greater economic certainty in some aspects, given a level of recovery in energy prices and inflation.”