Store openings in 2023 reached post-pandemic high – but closures still increasing

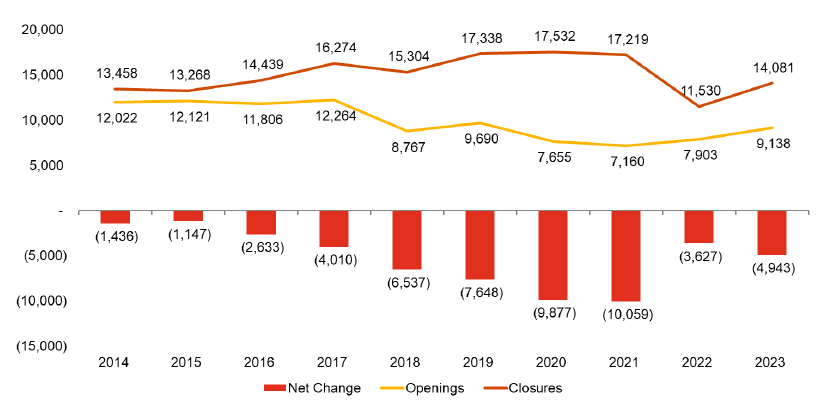

9,138 new stores opened in Great Britain in 2023, the highest figure since 2019, a new report has found.

However, the figures from PwC – with research undertaken by Local Data Company – found that the country witnessed an increase in both openings and closures in 2023 compared to the previous year.

The bi-annual report – which tracks over 200,000 outlets in more than 3,500 locations across the UK – recorded net closures of 14 stores a day in 2023. This was higher than in 2022 (10 a day) but lower than in 2018-2021.

PwC/Local Data Company

According to the report, this acceleration in store closures can primarily be attributed to one-off large-scale restructuring in parts of retail and hospitality. In total, there was 14,081 store closures in 2023, an average of 39 closures per day. The figure is higher than 2022’s total of 11,530, but lower than every year between 2017 and 2021, and in line with 2016 (14,439).

Despite the overall decline, there was a rebound in the hospitality sector, with a notable surge in new openings. Five of the top seven categories of new openings were in this sector, with takeaways (+151), food-to-go (+131), cafes (+104), coffee shops (+74) and restaurants (+21) all performing well in 2023.

The other top growing categories were supermarkets (+40) and petrol stations (+48).

The majority of these new openings were located in retail parks and other out-of-town or edge-of-town locations, rather than on high streets. The number of retail park chain outlets grew in 2023 by 0.3%, while there were declines in high streets (-3.3%) and shopping centres (-2.5%).

Many of the closures can be attributed to shifts in how customers engage with services. Notable examples include banks (-583 stores in 2023) and betting shops (-193), which have moved many of their services online.

PwC said that the other main categories of chain closures were driven by one-off, large-scale restructurings or administrations of major operators. In the case of pubs (-722 in 2023), variety retailers (-418) and cards and stationery retailers (-170), none of these were in the top 20 declining categories in 2022, and they are not expected to be amongst the worst performers in 2024.

The report said that whilst fashion retailers saw two large chains fall into administration earlier in 2023, the net decline of 325 closures is substantially lower than in the middle of the pandemic, when almost 1,400 chain outlets closed in 2021.

In the worst two performing categories, pharmacies (-787) and pubs, some outlets have been taken over by independent operators or are being marketed to other chains, so the overall loss is expected to be smaller once restructurings are completed.

Lisa Hooker, leader of industry for consumer markets at PwC, said: “A combination of the lagged impact of the pandemic together with inflation across the cost base has seen an acceleration in chain stores exiting the market in 2023 at 14 stores a day and some disappointing results across the independents sector. We believe the step-up in net closures reflects more one-off failures and will improve this year. It also shows the impact of the trend of wanting to shop and consume services seamlessly across different channels with longer-term growth in spending online mirroring the annual net closures in physical sites.

“There are some bright spots in terms of net openings of leisure operators and in retail parks, reflecting our desire for experiences over ‘stuff’, as well as for convenience. Overall this does suggest a continued need for retailers, landlords and the local government to work together to understand why consumers prefer retail parks and how they can revitalise and reposition high streets to meet future consumer needs; and also for our industry to embrace the latest technology and use of data to win the battle for share of wallet and stomach.”

Lucy Stainton, commercial director for the Local Data Company, added: “The notable aspect of these latest figures is the substantial rise in overall market activity throughout 2023. 2022 by comparison saw much more moderate volumes of churn, but as we look at last year, both store opening numbers and store closure numbers had both increased dramatically. Many larger operators were still repositioning and consolidating their portfolios, as consumer spending remained cautious, resulting in more closures than openings. This activity, alongside shorter average lease lengths and some corners of the market, predominantly in the leisure space, looking to take advantage of changing consumer habits and a more flexible property market, all contributed to much higher activity levels on both sides. Whilst we’re still facing sustained economic headwinds alongside some political uncertainty this year, the increasing store openings suggests we may see this gap close somewhat as we move through 2024.”