Occupiers look to location economics

With lease lengths having progressively shortened and rents significantly rebased, property has become less of a financial factor for retailers and F&B operators who are looking to expand or reorientate their networks.

While the level of business rates remains a material consideration and staff costs have risen since the pandemic and Brexit, occupiers are increasingly looking to data regarding the economic setting of potential new stores and how their offer may fit target locations.

The retail industry and the property sector which supports it are no strangers to population demographics but a growing band of businesses are now looking to the wider economic picture across the UK to guide their strategy.

There is a direct correlation between economic vitality and the drivers of a local economy with its ability to sustain certain types of retailing. And, of course, especially at times like these, retailers who are ‘value propositions’ will invariably not be looking for economies that are on the upgrade as they are targeting people who are carrying out a downward shift in their spending habits.

To get a more complete picture of what is happening across a local economy, you need to consider more than the ‘ABC1’ etc demographic ratings. Government devolution policy is having a profound effect on economies. For example, the £4bn expanded devolution deal for the North East which was announced late last year aims to create 24,000 extra jobs and leverage £5bn of private sector investment. Even though the future of the longer term ‘Levelling Up’ strategy may be unclear at present, these devolution packages are being put in place and will have an impact.

The Evaluate|Locate economic index is a response to these micro and macro situations. It brings together 96 different metrics to index rate economic vitality across every location in the UK from postcode granularity outwards. It has applications for many stakeholders across the property business. It can support the rationale for investment; shape development; help portfolio managers track the economic setting of their assets and guide the expansion plans of retailers, F&B operators and many other businesses which depend on local economies.

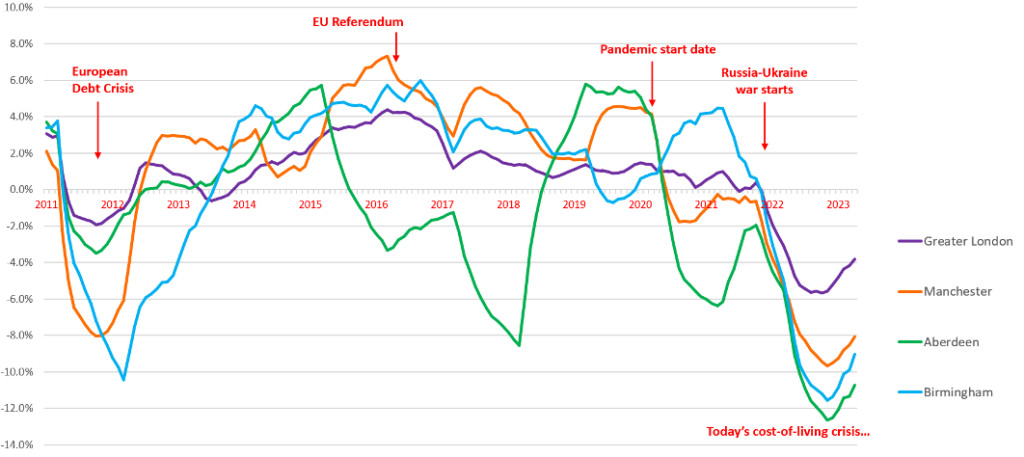

Crucially, as the UK moves on from the seismic impacts of the pandemic and last year’s exceptional events, localised will not respond in the same way during this period. The chart below shows the economic vitality index for some major UK cities since how they have responded from 2011 through to the end of this April. The variance in each cities’ economic trajectory vividly illustrates to what extent locations respond differently to the same factors.

Sample UK Cities

12-month % change in Economic Vitality Index Rating 2011-2023

This is the model’s ‘big picture’ but an index drill-down enables users to see how the factors which can be integral to the success of their businesses are moving: how average earnings in an area have moved in the past year; how average residential values have shifted and what are the business sectors that now dominate a location’s economy. All of these can be benchmarked against the median rating of all UK locations or, more intriguingly, other specific locations.

At the time of writing, Poole, Harrogate, Glasgow, Redditch and Ashford in Kent all have the same economic vitality index-rating. For a retailer who is successfully trading in one of these locations but not the others, it can be the beginning of a fascinating exploration into what setting may be most productive for their business.

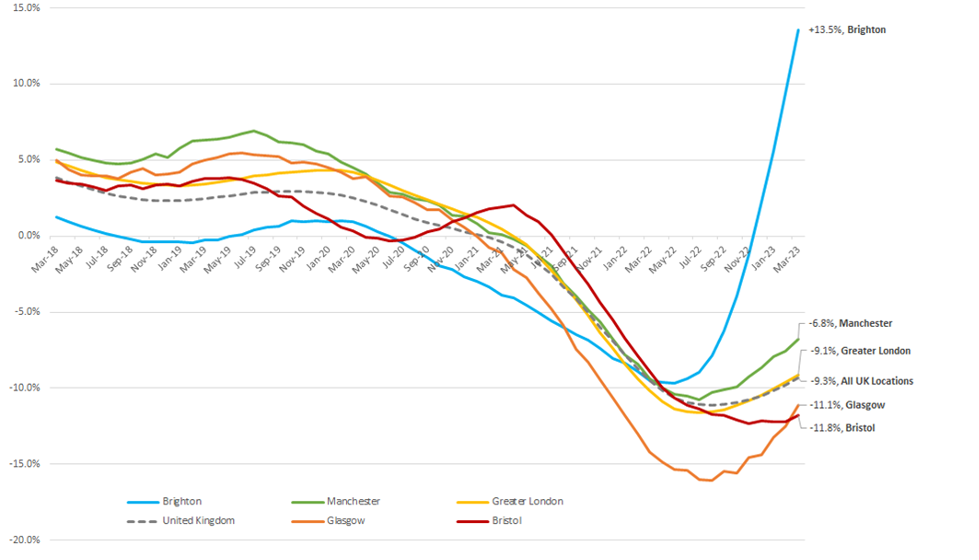

UK business sectors are also moving on very different trajectories. For example, in the 12 months to the end of this March, Brighton saw the number of its active local tech businesses grow by 13.5% following a migration of talent out of London. This growth was hugely at variance with other established tech hub cities.

UK tech sector

12-month % change in active businesses by location March 2018-March 2023

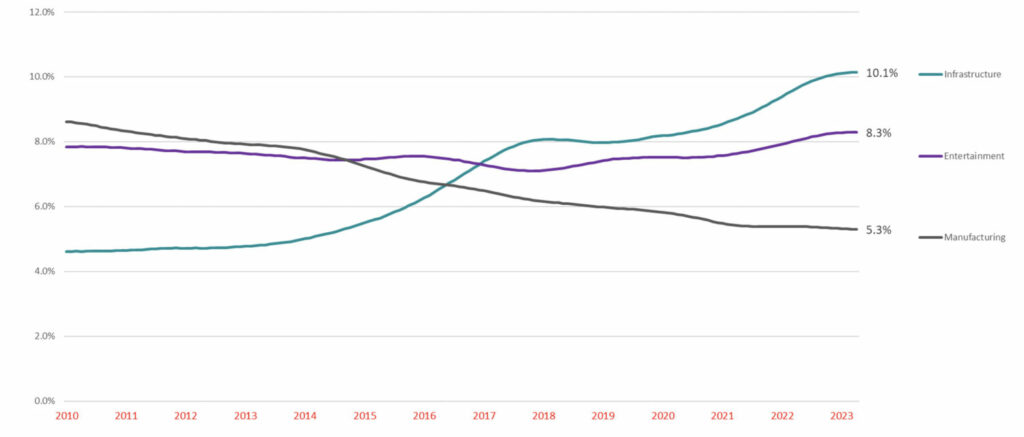

The West Midlands is a location traditionally associated with manufacturing but since 2014 the proportion of the region’s active businesses involved in manufacturing has been outstripped by the entertainment and leisure sector.

The Changing Face of the West Midlands Economy

Selected business sectors as a proportion of the total across the West Midlands Combined Authority

These data perspectives break down stereotypical views of locations and provide invaluable context for business looking to either establish themselves in and area or expand into it.

And for property agents, at a time when there is not much tension in the supply-demand equation, it is an opportunity to take a wider perspective and more closely identify with the occupier mindset.

Duncan Lamb is a Director at Evaluate|Locate