Report: UK competitive socialising sector growing at rapid rate

The UK competitive socialising sector has grown at a rapid rate over the past seven years, according to a new report from Savills.

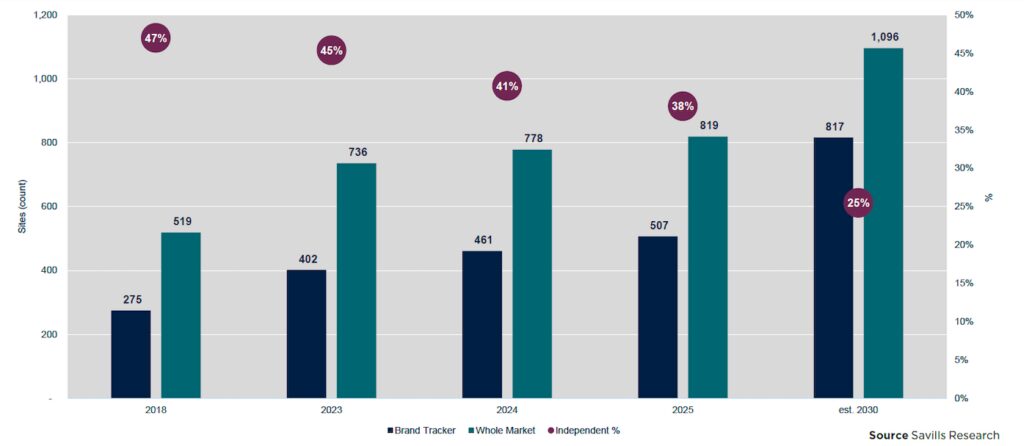

According to the international real estate advisor’s Competitive Socialising Brand Tracker, there are now 800 competitive socialising venues nationwide, up 58% since 2018.

The research also found that multi-site operators now account for over 500 venues, an 84% increase since 2018, whereas independents have fallen from 50% to under 40% of the market.

Looking ahead, Savills forecasts that the market will reach 1,100 sites by 2030, with multi-site brands making up 75% of the sector.

Competitive socialising encompasses a mix of experiential activities such as axe throwing, escape rooms, darts, bowling, crazy golf, and virtual reality.

Venues that combine multiple activities under one roof have seen the fastest growth, rising from 11 sites in 2018 to 84 today, with Boom Battle Bar, Roxy Ballroom, and Lane7 leading the charge with 66 sites combined. Solo sports remain strong, with Flight Club and Sixes each operating 14 sites, while indoor crazy golf has doubled to 100 venues, led by Mr Mulligans with 15 sites. Escape rooms remain the most fragmented sub-sector, with over 225 venues nationwide, 60% of which are independent.

Carlene Hughes, head of UK restaurants and leisure at Savills, said: “Boundaries between sub-sectors are becoming increasingly blurred. Bowling has reinvented itself by adopting competitive socialising elements, and now immersive experiences are competing for the same consumer spend. The next frontier is where theatre and gameplay converge, as seen in game show-inspired concepts like Monopoly Lifesized and The Cube. These formats leverage strong IP and nostalgia, creating high-quality, memorable experiences. While still niche, they signal a broader trend: leisure is no longer about a single activity, but about layered, immersive environments that keep consumers engaged and coming back.”

Savills said that larger cities, which were the focus of the initial boom, are now approaching saturation for certain concepts, and some markets will likely see consolidation. Looking ahead, brands will likely look to smaller towns, European markets, and rethink their space requirements – from large-format venues of 30,000 sq ft for multi-activity concepts, to smaller footprints in high-rent locations.

Tom Whittington, director in commercial research at Savills, added: “As the sector matures, the challenge is no longer just finding space, it’s finding the right space. Operators are balancing two extremes: large-format venues to house multiple activities under one roof, and smaller footprints in high-rent locations or towns with limited catchment. At the same time, cost pressures – from wage inflation to business rates – are squeezing margins, and consumers are becoming more selective about where they spend. The initial halo effect of a new opening fades quickly, so brands must continually refresh their offer to drive repeat visits. Success now depends on adaptability and quality.”